Search Results for: financial debt

Why You Should Absolutely Avoid the “Bank Glitch” Trend: Protect Your Financial Future

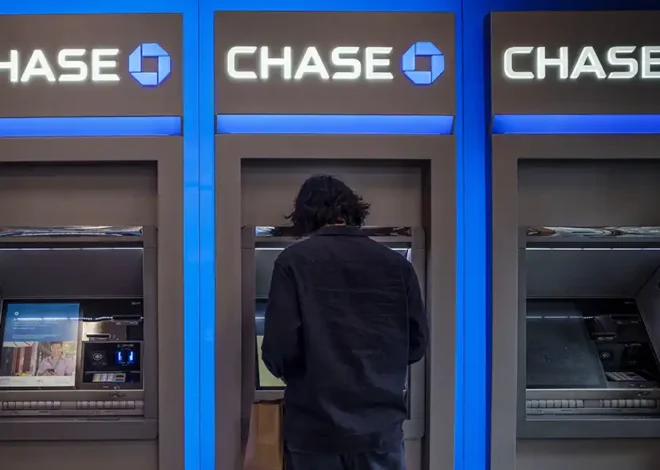

As a mom of three and a financial advisor, I’ve seen firsthand how essential it is to teach kids about budgeting, saving, and financial responsibility. Equally important is educating them on what not to do, and here’s a prime example: a dangerous trend is circulating on social media, encouraging people to exploit a supposed “bank glitch” to withdraw free cash from ATMs. While this may seem harmless in viral videos, it is actually bank fraud and can lead to serious legal trouble for you or your kids.

3 Financial Moves to Make Before You Buy a Home

Home sales in the U.S. are skyrocketing as interest rates remain at historically low levels. In fact, Zillow expects nearly 7 million existing-home sales this year—the most since 2005. With so many prospective homebuyers on the market, you too may be wondering if it’s time to take the plunge into homeownership. Before you begin hunting…

3 Financial Steps to Take Before Year-End

A new year is quickly approaching and that means a fresh start. Among the most common new year resolutions, money goals often take the lead. In fact, the 2020 New Year Financial Resolutions Study by Fidelity Investments found that 67% of respondents made a financial resolution including saving more, paying down debt and spending less.…

Three Crucial Ingredients to Creating Financial Security for Your Family

Life is full of unpredictable moments, especially when you have kids. But, for us parents, we wouldn’t have it any other way. The good news is, establishing routines and habits can help you take some control over your life and ease anxiety. One of the most important places you should focus on is your finances.…

Your Financial Therapist Goes to Boot Camp

Anyone who knows me knows that I dont jump. I dont like anything to do with jumping. My excuse has always been that I have big breasts and this makes me want to stay low to the ground. Well about a year ago, I lost a pregnancy. It was the last time I would be trying to have a child and it was quite a harrowing experience to say the least. My best …