Search Results for: accounts

Pay Down Holiday Debt Quickly in 5 Simple Steps

If you're among the 36% of shoppers who racked up $1,181 in holiday debt, don't dilly dally. Taking action quickly to pay down these balances will help you save money and avoid useless fees. Tackling debt is overwhelming if you don't know where to start. However, this step-by-step guide will show you how to pay…

Top 10 Apps to Track Holiday Expenses

Managing holiday spending is no easy task, especially with the pressures of gifts, gatherings, and travel. Here are the top 10 apps to track holiday expenses. They will help you track every penny and stay on budget this holiday season. These apps offer excellent features for both families and individuals, and each includes a review quote and a specific use case to bring the app to life!

The Five Things I Learned In My Rookie Year Being A Working Mom

This Fall, I celebrated my first anniversary of returning to “working mom” after becoming a first-time mother. Ironically, in the same month, I started a new job. In retrospect, it’s not a coincidence. They say the first year is the hardest for significant life changes. It’s a period of unknowns, new obstacles, and inevitable mistakes made along the way. And frankly, since I don’t have much to compare it to at this point, I’d say year one of being a working mom was quite the cluster.

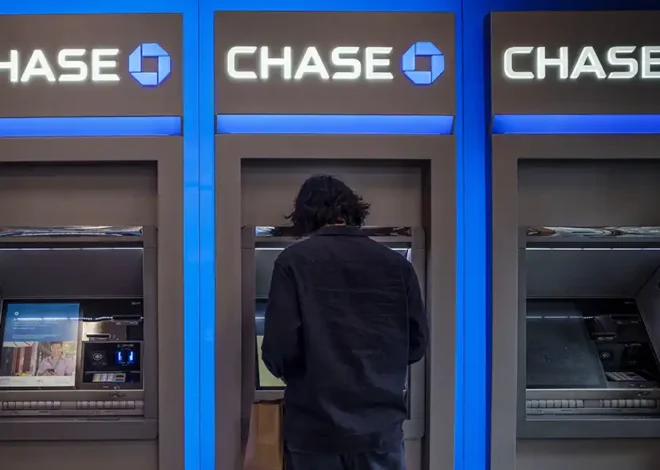

Why You Should Absolutely Avoid the “Bank Glitch” Trend: Protect Your Financial Future

As a mom of three and a financial advisor, I’ve seen firsthand how essential it is to teach kids about budgeting, saving, and financial responsibility. Equally important is educating them on what not to do, and here’s a prime example: a dangerous trend is circulating on social media, encouraging people to exploit a supposed “bank glitch” to withdraw free cash from ATMs. While this may seem harmless in viral videos, it is actually bank fraud and can lead to serious legal trouble for you or your kids.

1 in 10 Young College Graduates is ‘Idled’—What Parents Need to Know and Tips to Help

Last night a parent friend called me and talked about her older son moving home, and having a hard time finding work. After working hard on a degree in BioEngineering, he realized his true love was in the theater arts, but he also knew he needed to find work to support himself. So, for now,…