Search Results for: paying tax

Maximize Your Money: Smart Moves for Your Tax Refund!

Excited to see that money coming into the bank account? Already thinking about how to spend it in advance? It's important to recognize that receiving a tax refund isn't just a stroke of luck; it's a sign of financial responsibility and diligent tax planning. However, it's crucial not to fall victim to spending frivolously. Instead,…

Mommy’s Little Tax Deduction (What You Need To Know to File)

For so many mothers, the words tax and return fill them with absolute dread every spring. Even Albert Einstein joked: The hardest thing in the world to understand is the income tax.Though, with all due respect to the guy who developed the theory of relativity, Ive got to disagree on that one.

Do I Have to Pay Taxes on the Money My Grandmother Gives Me to Help With Her Care?

Getting her coffee and answering her mail may only be the beginning of the work you do for your grandmother. If you have a regular schedule with your grandmother, wherein you care for her and take care of her household and personal needs, she may feel compelled to pay you. If you’re wondering if you have to pay taxes on the money she gives you, take into consideration the intent and amount of money you will be getting.

Divorce & IRA Accounts

During the course of a divorce, any assets you and your spouse had will need to be divided. With the help of your lawyers or a mediator, you will decide who gets what property, how to divide your savings and how to divvy up the retirement accounts. Splitting up the 401(k)s and the IRAs is a bit trickier than simply dividing a regular savings account.

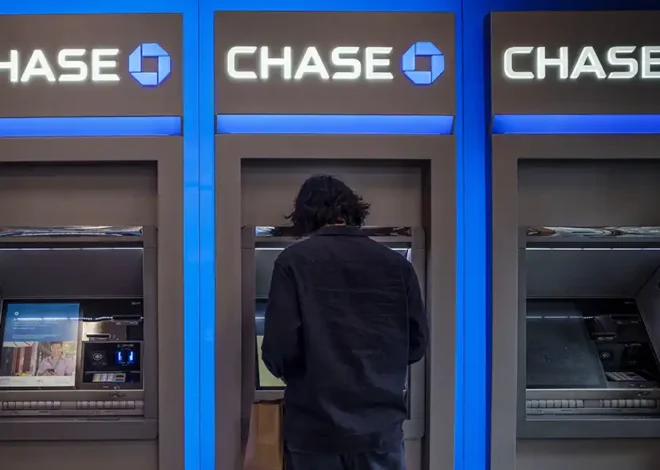

Why You Should Absolutely Avoid the “Bank Glitch” Trend: Protect Your Financial Future

As a mom of three and a financial advisor, I’ve seen firsthand how essential it is to teach kids about budgeting, saving, and financial responsibility. Equally important is educating them on what not to do, and here’s a prime example: a dangerous trend is circulating on social media, encouraging people to exploit a supposed “bank glitch” to withdraw free cash from ATMs. While this may seem harmless in viral videos, it is actually bank fraud and can lead to serious legal trouble for you or your kids.