Search Results for: investment income

How to Build Your Child’s Investment Portfolio

Although most parents are financially savvy enough to save for their retirement, saving for their children sometimes takes the back burner. With limited cash on hand and the feeling that the children will be young forever, most put off building a substantial investment portfolio for their child. But with government incentives and expert advice, there are some great options to help you save for your child. Follow these five steps to get on the right track.

Tax Time is Approaching: Get Organized Now!

To get organized for April 15, 2012, start now! There are several ways you can get yourself organized for tax season.

Avoid the April 15th Mad Dash With This Tax Prep Schedule

In eight short weeks, whether you like it or not, your tax return is due. Dont let it sneak up on you. Theres no reason tax time has to be a stressful flurry of last-minute preparations capped off with a sprint to the post office (or accountant). If you take a few little steps each week, youll be pleasantly surprised at how much easier it all comes together on April 15th. But, unless youre a financial-type, you may not be sure how to break down such a daunting task. That is why weve put together this tax prep schedule. Although it may seem like a lot of steps, the average appointment on the following list should take you no more than sixty minutes to complete and many may take less than five. Stick to this schedule and youll be more likely to make it through this tax season gauntlet mistake-free and with sanity in tact.

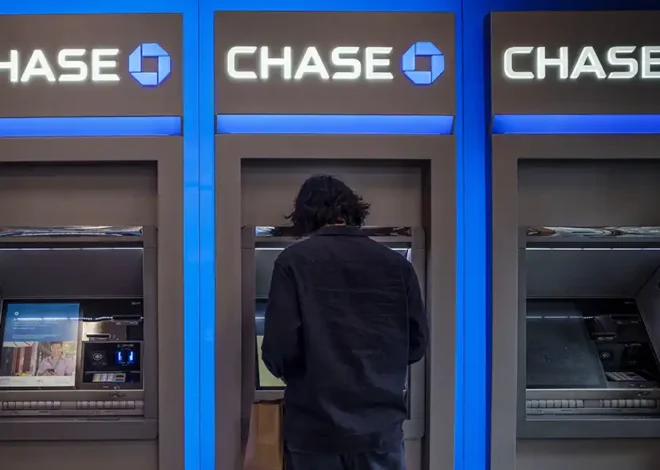

Why You Should Absolutely Avoid the “Bank Glitch” Trend: Protect Your Financial Future

As a mom of three and a financial advisor, I’ve seen firsthand how essential it is to teach kids about budgeting, saving, and financial responsibility. Equally important is educating them on what not to do, and here’s a prime example: a dangerous trend is circulating on social media, encouraging people to exploit a supposed “bank glitch” to withdraw free cash from ATMs. While this may seem harmless in viral videos, it is actually bank fraud and can lead to serious legal trouble for you or your kids.

How To Find A New Revenue Source When You Have A Small Baby At Home

Juggling the responsibilities of a job and your brand new baby may seem impossible, but even harder is finding a new job or a new revenue source. Whether you are navigating to find additional revenue streams or landing a new primary revenue stream, here are some tips that may help you while you have a…