Search Results for: Accounts

Divorce & IRA Accounts

During the course of a divorce, any assets you and your spouse had will need to be divided. With the help of your lawyers or a mediator, you will decide who gets what property, how to divide your savings and how to divvy up the retirement accounts. Splitting up the 401(k)s and the IRAs is a bit trickier than simply dividing a regular savings account.

How to Teach Kids About Checking Accounts

Money education is an important and sometimes overlooked lesson that parents forget to share with their kids. It is important for kids to learn how to budget the money they have available to them and how to balance a checkbook. When kids see mom and dad pull out credit or debit cards, they may not realize that there is more to managing money and a checking account than just swiping a card. Any money management lesson also gives you a chance to spend time with your kids, and to gauge their basic math skills.

Building a Savings Accounts

Experts say that individuals should have a year’s worth of living expenses stuffed into their savings account in case of an emergency. It’s hard to imagine saving just a few months’ worth of pay–much less an entire year’s worth. However, there are some easy methods you can use to build a savings account that will continually draw interest and will be there in case of an emergency.

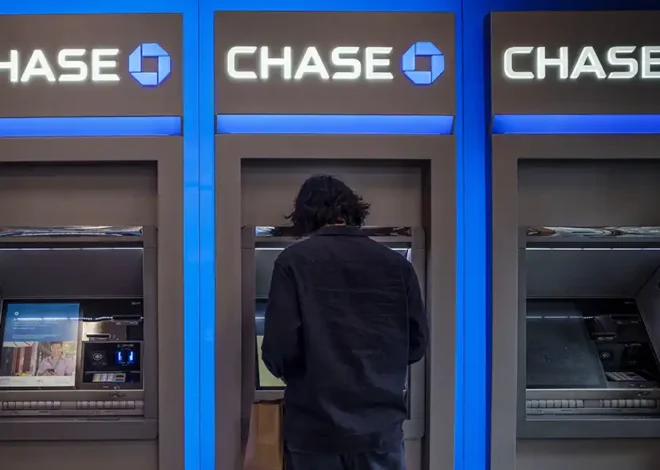

Why You Should Absolutely Avoid the “Bank Glitch” Trend: Protect Your Financial Future

As a mom of three and a financial advisor, I’ve seen firsthand how essential it is to teach kids about budgeting, saving, and financial responsibility. Equally important is educating them on what not to do, and here’s a prime example: a dangerous trend is circulating on social media, encouraging people to exploit a supposed “bank glitch” to withdraw free cash from ATMs. While this may seem harmless in viral videos, it is actually bank fraud and can lead to serious legal trouble for you or your kids.

1 in 10 Young College Graduates is ‘Idled’—What Parents Need to Know and Tips to Help

Last night a parent friend called me and talked about her older son moving home, and having a hard time finding work. After working hard on a degree in BioEngineering, he realized his true love was in the theater arts, but he also knew he needed to find work to support himself. So, for now,…